Table Of Content

Refinancing at lower rates is always a good idea as long as the homeowner plans on staying in the home long enough to justify the closing costs of the loan. If the current rate is significantly lower than the original, the homeowner might consider shortening the new loan’s maturity. Monetary policy is one of the most important drivers of mortgage rates. In particular, following the Great Recession, in economic downturns, the Federal Reserve has been aggressively trying to influence long-term rates in the economy through quantitative easing (QE). You might qualify for the best current mortgage rate if you can make a 20% (or larger) down payment. That's because making a bigger down payment reduces your loan-to-value ratio, which lowers the risk for the lender, which in turn could qualify you for a lower rate.

Mortgage payment equation

While last year saw rates soaring to unprecedented highs, the year ahead is poised to be another turning point in the mortgage world. At the January Federal Reserve meeting, it was hinted that there could be three rate cuts, rather than hikes, anticipated for 2024. Most economists widely expect a decline from the peak rates seen last year—but only a modest one. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Frequently asked questions about mortgages

Average Mortgage Interest Rates: Mortgage Rates by Credit Score, Year, and Loan Type - Business Insider

Average Mortgage Interest Rates: Mortgage Rates by Credit Score, Year, and Loan Type.

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

Our editorial team does not receive direct compensation from our advertisers. We are an independent, advertising-supported comparison service. The most common terms are the 30-year fixed-rate mortgage, the 15-year fixed, and the 5-year adjustable-rate mortgage.

How Today’s Mortgage Rates Affect Your Monthly Payments

A discount point can lower interest rates by about 0.25% in exchange for upfront cash. Mortgage rates had dropped lower in 2012, when one week in November averaged 3.31 percent. But some of 2012 was higher, and the entire year averaged out at 3.65% for a 30-year mortgage. The lower your rate, the more you'll be able to borrow, so shop around and get preapproved with multiple mortgage lenders to see who can offer you the best rate. But remember not to borrow more than what your budget can comfortably handle.

Nonetheless, experts foresee an inevitable downward trend, though probably not in the immediate future. For those hoping to refinance, mortgage rates are not cooperating. Since mortgage rates often react to the Fed’s actions, this latest pause means that home buyers may have to wait a bit longer to see improvements in affordability. In the meantime, motivated buyers and sellers will need to get creative. In this post we’ve tracked rates for 30-year fixed-rate mortgages.

What are today’s interest rates?

Let us estimate your rate and help you reach your financial goals. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. Mortgage rates tend to follow the 10-year Treasury note, as ten years is close to the average tenure of home ownership.

Treasury & payment solutions

You may be able to pay a percentage of the interest up front to lower your interest rate and monthly payment. A mortgage point is equal to about 1% of your total loan amount, so on a $250,000 loan, one point would cost you about $2,500. The annual percentage rate (APR) represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased or decreased after the closing date for adjustable-rate mortgages (ARM) loans. Though mortgage rates and home prices are high, the housing market won’t be unaffordable forever. It’s always a good time to save for a down payment and improve your credit score to help you secure a competitive mortgage rate when the time is right.

Find the best mortgage rates for your home loan

Your mortgage interest rate is part of your APR, but APR also includes additional borrowing costs such as mortgage insurance premiums or other fees that make your loan possible. Your credit score has one of the biggest impacts on your mortgage rate as it’s a measure of how likely you’ll repay the loan on time. The exact lock period may vary, but typically you can lock in a mortgage rate for 30 to 60 days. If the rate lock expires, you’re no longer guaranteed the locked-in rate unless the lender agrees to extend it. It’s possible for your initial rate lock to be voided if things like your credit score, loan amount, debt-to-income ratio or appraisal value change during the lock period.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

A typical interest rate accounts only for the fees you’re paying a lender for borrowing money. An APR, on the other hand, captures a broader view of the costs you’ll pay to take out a loan, including the interest rate plus closing costs and fees. Be sure to shop for those quotes on the same day, since mortgage interest rates change on a daily basis. And don’t forget to look at the annual percentage rate (APR) for each offer — this will show you the true cost of a given loan, including interest and fees. While mortgage rates change daily, it’s unlikely we’ll see rates back at 3 percent anytime soon.

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team.

Some charge higher rates on jumbo loans, some charge lower rates for jumbo loans. For these averages, APRs and rates are based on no existing relationship or automatic payments. If and when the Fed cuts interest rates depends on incoming economic data, such as the rate of inflation and the jobs market. The Fed indicated it'd cut rates in 2024, but policymakers held off at its latest meeting, citing the need for more promising economic data. The Fed has been working to bring inflation back to its 2 percent target since 2022.

The same loan size with a 15-year fixed rate of just 6.0% would cost only $207,624 in interest — saving you around $302,757 in total. If possible, give yourself a few months or even a year to improve your credit score before borrowing. You could save thousands of dollars through the life of the loan. A credit score above 720 will open more doors for low-interest-rate loans, though some loan programs such as USDA, FHA, and VA loans can be available to sub-600 borrowers.

On a 15-year fixed mortgage, the average rate is 6.93%, and the average rate on a 30-year jumbo mortgage is 7.69%.Current Mortgage Rates for April... As The Ascent's Compliance Lead, he makes sure that all the site's information is accurate and up to date, which ensures we always steer readers right and keeps various financial partners happy. Money can't buy happiness, but it can usually buy a lower mortgage interest rate. You pay a fee when you get the loan, and your lender permanently reduces your interest rate. Buying points could be a good strategy if you plan to own the home for a long time.

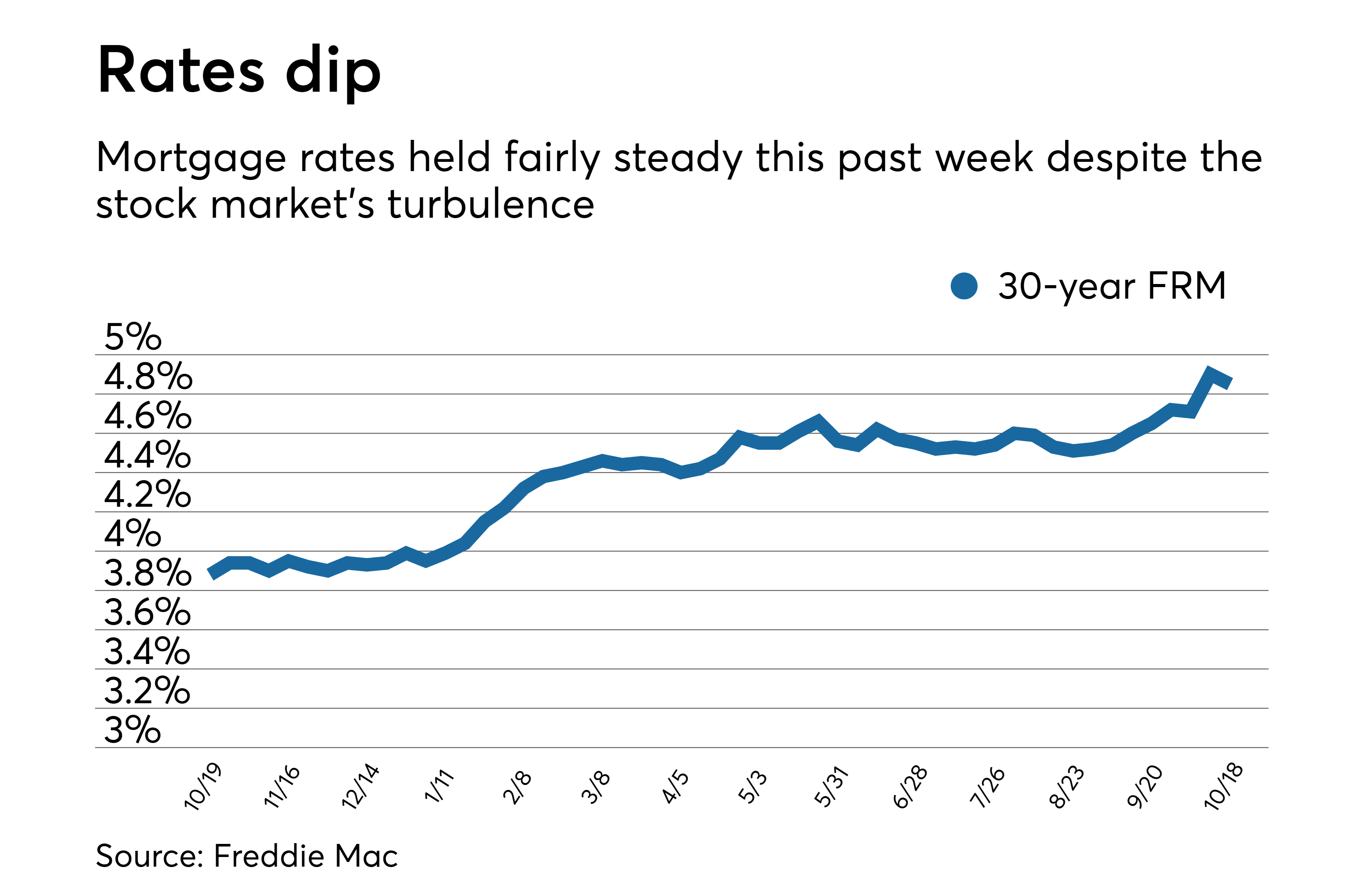

That’s an increase of nearly 400 basis points (4%) in ten months. Extremely high prices and an overall strong economy have led the Federal Reserve to take drastic measures, implementing a rapid succession of rate increases unseen since the early 1980s. Answer some questions about your homebuying or refinancing needs to help us find the right lenders for you. A home loan with an interest rate that remains the same for the entire term of the loan. Get the latest housing market news and expert analysis delivered straight to your inbox. A lot of first-time homebuyer programs — such as statewide and local down payment assistance — can help you come up with a bigger down payment.

Since last summer, the Fed has consistently kept the federal funds rate at 5.25% to 5.5%. Though the central bank doesn’t directly set the rates for mortgages, a high federal funds rate makes borrowing more expensive, including for home loans. Many homeowners have taken the opportunity to refinance in this low rate environment, and it isn't too late to do so.

No comments:

Post a Comment